Erc-3690 Protocol

Protocolo para real world asset, con funciones de tokenizar propiedades por fracción.

Dual Token Protocol The dual-layer token combines the functionalities of ERC-20, ERC-721, and ERC-1155 while adding a classification layer that uses (mainId) as the identifier for the main asset type and (subId) as the unique attributes or variations of the main asset.

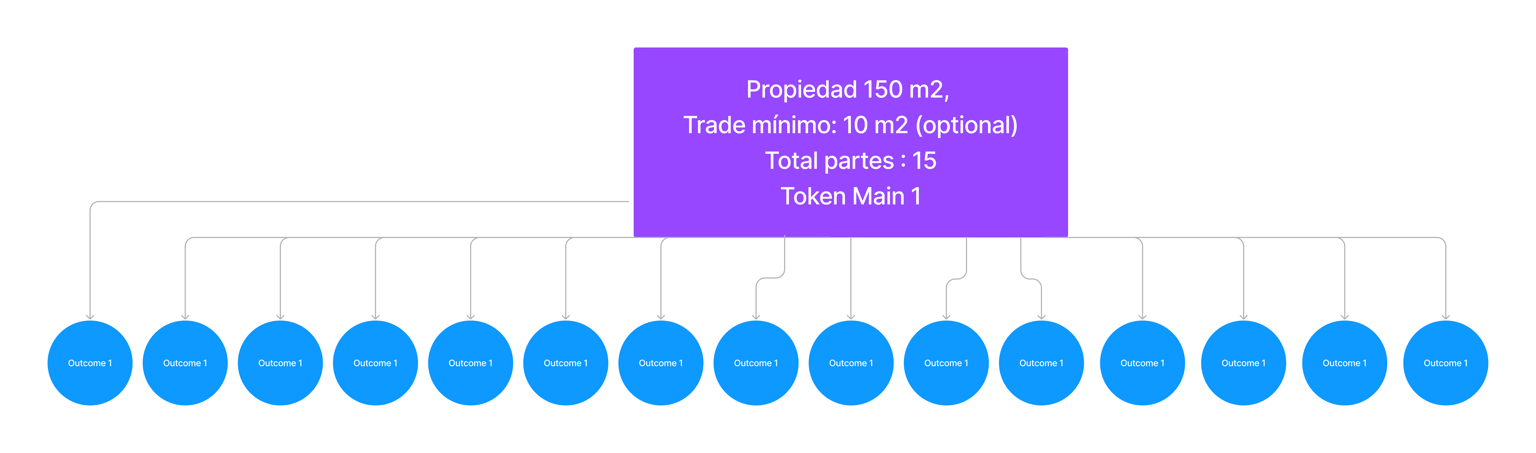

Each RWA or property is a distinct token and has a total supply limited to its scope. Each unit of this total supply is considered a supply dependent on the (mainId).

For example, a property of 150 square meters could be divided into 1 or 10 square meters, thus creating 15 distinct sub-tokens, which are compatible with the ERC-1155 protocol for trading and negotiation on web3 platforms.

The proposed token aims to offer greater granularity in token management, facilitating a well-organized token ecosystem and simplifying the process of token tracking within a contract.

This standard is particularly useful for tokenizing and enabling fractional ownership of Real World Assets (RWAs). It also allows for the efficient and flexible management of both fungible and non-fungible assets.

The following are examples of assets for which the DLT standard can represent fractional ownership:

Invoices

Company shares

Digital collectibles

Real estate

The ERC-1155 standard has seen considerable adoption within the Ethereum ecosystem; however, its design shows limitations when handling tokens with multiple classifications, particularly in relation to Real World Assets (RWAs) and asset fractionalization.

Example of Real Estate Fractionalization Using Other Protocols

ERC20 🏠 (All houses are the same and interchangeable) Problem: The ERC20 standard cannot represent a single property with different attributes.

ERC721 (Each house is unique but not interchangeable) Problem: The ERC721 standard cannot represent the fractional ownership of a single house.

ERC1155 (Houses are unique, and their parts are interchangeable) Problem: ERC1155 can represent a single house and its fractional ownership, but this requires creating two types of assets within the same contract.

DLT: Dual Layer Token

Solution: DLT tokens can efficiently represent a single house (MainId) and its fractional ownership (SubId) within the same contract, enabling greater versatility in the negotiation and trading of each asset.

Last updated